Navigating the Landscape: Understanding and Accessing Tax Parcel Maps in Los Angeles

Related Articles: Navigating the Landscape: Understanding and Accessing Tax Parcel Maps in Los Angeles

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape: Understanding and Accessing Tax Parcel Maps in Los Angeles. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding and Accessing Tax Parcel Maps in Los Angeles

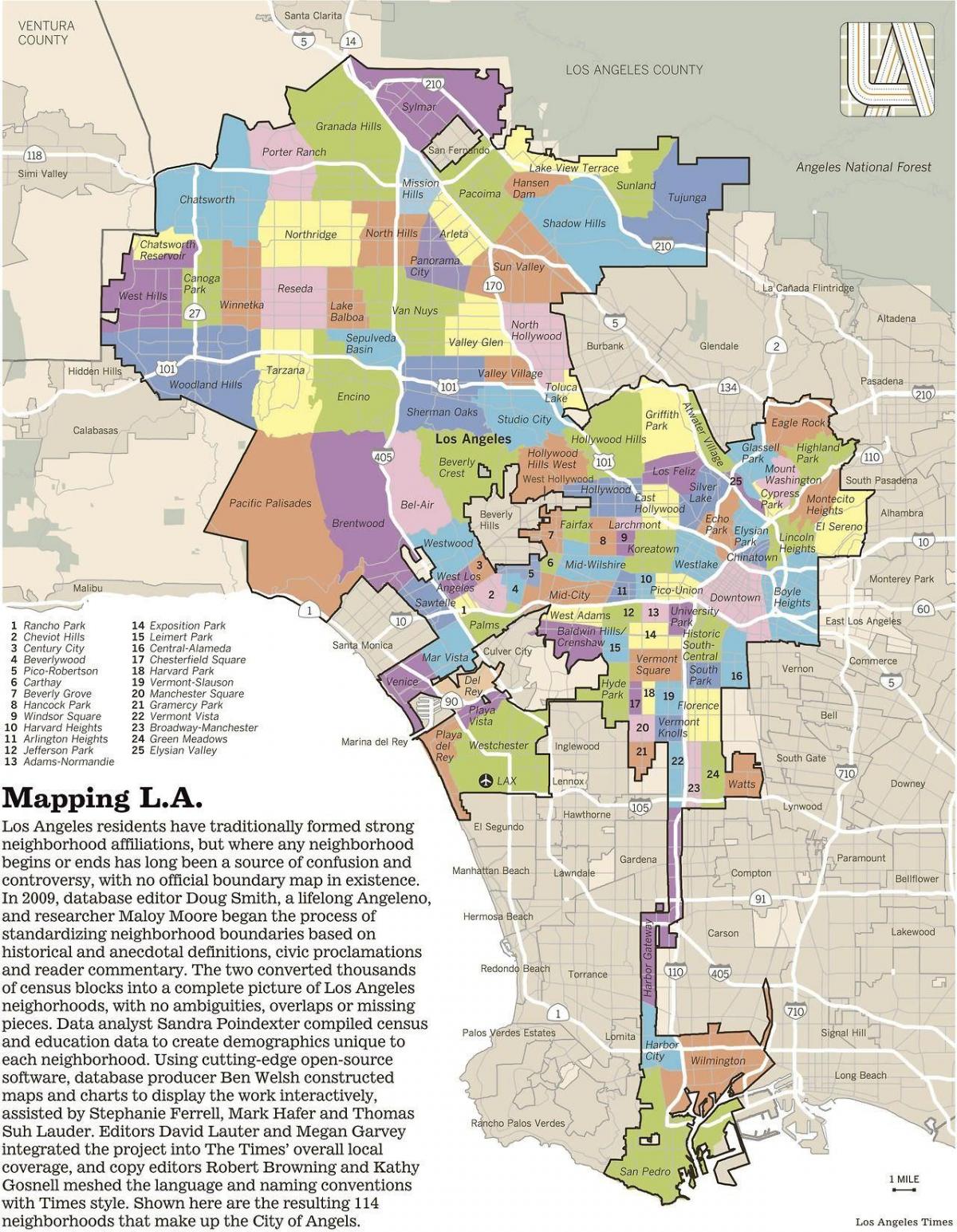

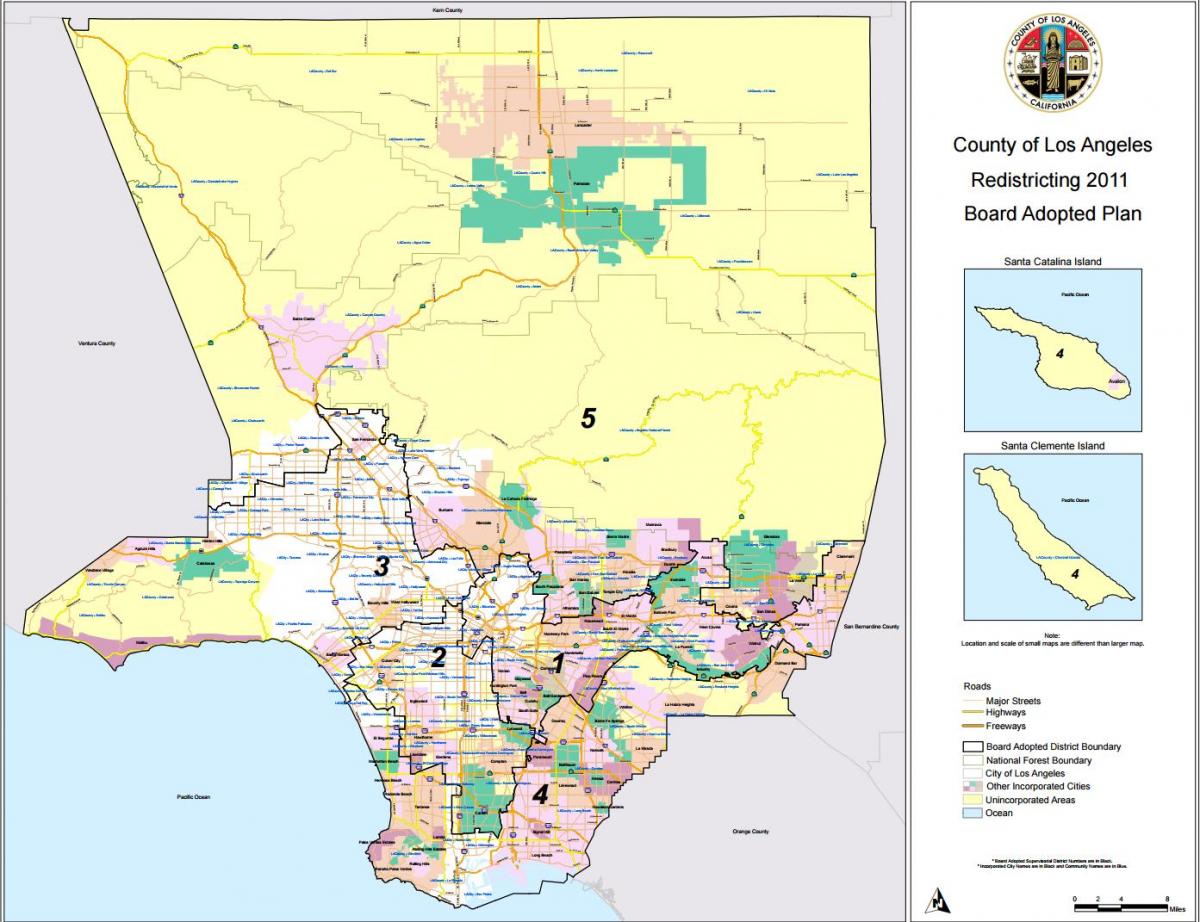

Los Angeles, a sprawling metropolis, is a complex tapestry of land ownership and property records. Navigating this intricate system requires understanding the concept of tax parcels and the tools available to access their associated maps. These maps, often referred to as "assessment maps" or "property maps," are essential for various purposes, ranging from real estate transactions and property development to legal disputes and historical research.

Understanding the Concept of Tax Parcels

A tax parcel is a unique identifier assigned to each individual piece of land within a jurisdiction. It is essentially a legal description of a property, encompassing its boundaries, size, and other relevant characteristics. This parcel number serves as a key to unlocking information about the property, including its ownership, assessed value, and any associated tax liabilities.

The Importance of Tax Parcel Maps

Tax parcel maps are indispensable tools for various stakeholders involved in the real estate ecosystem:

- Real Estate Professionals: Brokers, agents, and appraisers utilize these maps to accurately identify property boundaries, understand the surrounding neighborhood context, and assess the potential development opportunities of a property.

- Property Developers: Developers rely on parcel maps to evaluate the feasibility of new construction projects, ensuring compliance with zoning regulations and understanding potential environmental constraints.

- Lawyers and Legal Professionals: In legal disputes involving property ownership, boundaries, or easements, these maps provide crucial evidence to support claims and arguments.

- Historians and Researchers: For those delving into the historical evolution of land ownership and urban development, parcel maps serve as valuable historical documents, providing insights into the changing landscape of a city.

- Property Owners: Individuals seeking to understand their property’s boundaries, assess its value, or research potential development options can benefit from consulting tax parcel maps.

Accessing Tax Parcel Maps in Los Angeles

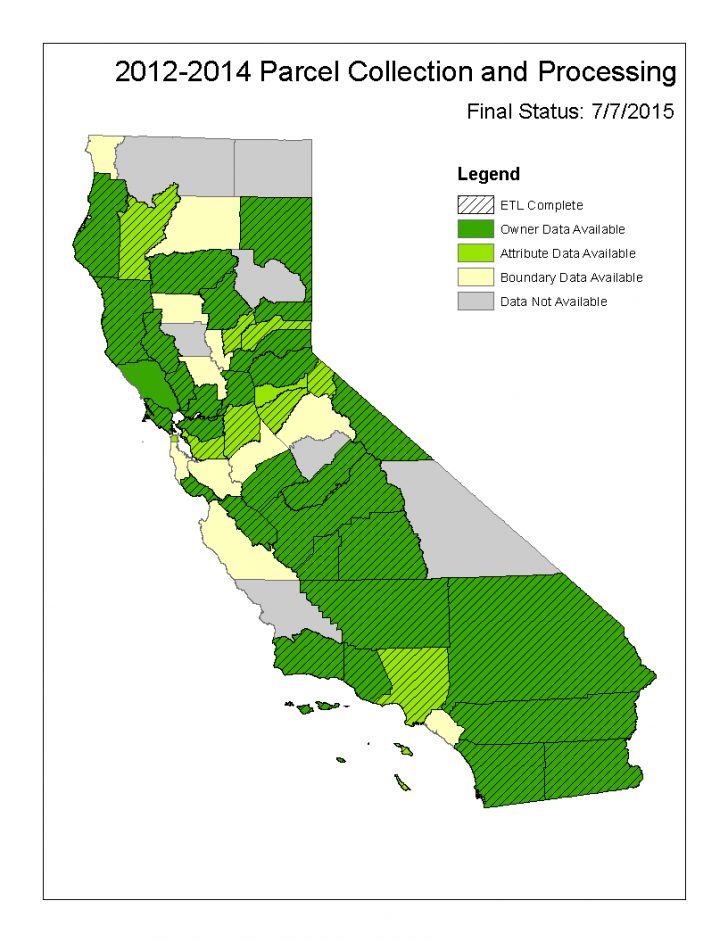

Los Angeles County provides several avenues for accessing tax parcel maps, each offering unique functionalities and levels of detail:

1. The Los Angeles County Assessor’s Office Website

- Direct Access to Maps: The Assessor’s website features an interactive mapping tool that allows users to search for properties by address, parcel number, or owner’s name. The resulting map displays the property boundaries, parcel number, and other relevant details.

- Data Download Options: The website also provides the option to download data in various formats, such as shapefiles, KML files, and CSV files. This data can be used for advanced mapping applications and analysis.

2. Online Mapping Services

- Google Maps: While Google Maps does not specifically display tax parcel boundaries, it can be used to identify properties and access additional information through the "Property Details" section, often linking to the Assessor’s website for more detailed information.

- Specialized Mapping Platforms: Several online mapping services, such as Mapbox and Esri, offer advanced mapping functionalities and integration with data sources like tax parcel data, allowing for customized map creation and analysis.

3. Public Records Access

- Assessor’s Office Records: The Los Angeles County Assessor’s Office maintains physical records that can be accessed in person. These records include detailed property maps, assessment records, and other relevant documents.

- County Recorder’s Office: The County Recorder’s Office houses official property deeds and other legal documents related to land ownership. These records can be accessed in person or through online search portals.

4. Third-Party Mapping Services

- Real Estate Websites: Websites such as Zillow, Redfin, and Trulia often display basic property information, including parcel boundaries, on their platform.

- Specialized Data Providers: Companies specializing in property data and analytics, such as CoreLogic and Zonda, offer access to comprehensive datasets, including tax parcel maps, for research and analysis.

Tips for Navigating Tax Parcel Maps

- Understand the Map Legend: Parcel maps often utilize specific symbols, colors, and abbreviations. Familiarize yourself with the map’s legend to interpret the information correctly.

- Utilize Search Tools: Most online mapping platforms offer advanced search filters, allowing you to refine your search based on specific criteria like address, parcel number, or property type.

- Combine Multiple Data Sources: For comprehensive analysis, consider integrating data from various sources, such as tax parcel maps, aerial imagery, and demographic data.

- Verify Information: Always verify the accuracy of information obtained from online sources by cross-referencing it with official records or contacting the Assessor’s office.

FAQs

Q: What information can be found on a tax parcel map?

A: Tax parcel maps typically include the following information:

- Parcel Number: A unique identifier for each property.

- Property Boundaries: The precise location and shape of the property.

- Ownership Information: The names of the property owners.

- Zoning Information: The zoning regulations that apply to the property.

- Assessed Value: The estimated market value of the property for tax purposes.

Q: Are tax parcel maps always accurate?

A: While tax parcel maps are generally reliable, there may be occasional inaccuracies due to errors in data entry, surveying, or changes in property boundaries over time. It is always advisable to verify information with official records or consult with a professional surveyor.

Q: How often are tax parcel maps updated?

A: Tax parcel maps are typically updated annually, reflecting changes in property ownership, boundaries, or assessed values.

Q: Can I use tax parcel maps for personal use?

A: Tax parcel maps are public records and can be accessed by anyone for personal use. However, it is important to respect the privacy of individuals and avoid using the information for unauthorized purposes.

Conclusion

Understanding and accessing tax parcel maps is crucial for navigating the complex landscape of property ownership and development in Los Angeles. By leveraging the tools and resources available, individuals, professionals, and researchers can gain valuable insights into property boundaries, ownership, and other relevant information. Whether for real estate transactions, development projects, legal disputes, or historical research, these maps serve as essential guides for understanding the intricate tapestry of land ownership within the city.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding and Accessing Tax Parcel Maps in Los Angeles. We thank you for taking the time to read this article. See you in our next article!