Navigating the London Property Landscape: A Guide to Understanding the Help to Buy Scheme

Related Articles: Navigating the London Property Landscape: A Guide to Understanding the Help to Buy Scheme

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the London Property Landscape: A Guide to Understanding the Help to Buy Scheme. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the London Property Landscape: A Guide to Understanding the Help to Buy Scheme

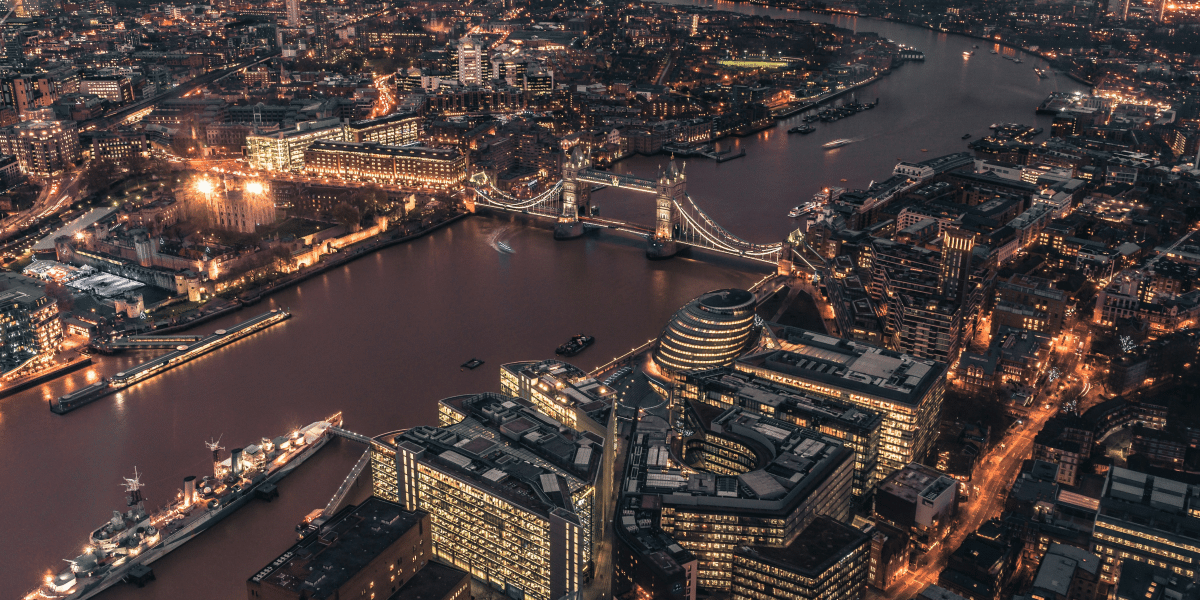

The dream of owning a home in London, a city renowned for its vibrancy and opportunity, is often met with the daunting reality of soaring property prices. However, the government’s Help to Buy scheme has emerged as a beacon of hope, offering a lifeline to aspiring homeowners seeking to navigate the complex and competitive London property market. This comprehensive guide delves into the intricacies of the Help to Buy scheme, providing a clear understanding of its workings, benefits, and implications for potential buyers.

Understanding the Help to Buy Scheme: A Foundation for Homeownership

The Help to Buy scheme, introduced in 2013, is a government-backed initiative designed to make homeownership more accessible for first-time buyers and those looking to move up the property ladder. It operates through an equity loan, providing a financial boost to buyers who struggle to meet the deposit requirements for a mortgage.

Types of Help to Buy Schemes:

- Help to Buy: Equity Loan: This scheme, available across England, offers a government loan of up to 20% of the property value (40% in London) for newly built homes. This loan is interest-free for the first five years and is repayable when the property is sold.

- Help to Buy: Shared Ownership: This scheme allows buyers to purchase a share of a property, with the remaining share owned by a housing association. Buyers pay rent on the remaining share and can increase their ownership over time.

Navigating the London Property Landscape with Help to Buy:

The Help to Buy scheme, particularly the Equity Loan, has proven particularly impactful in London, where property prices are significantly higher than the national average. This scheme has enabled many individuals and families to purchase homes in the capital, contributing to a burgeoning new housing market.

Key Benefits of Help to Buy in London:

- Reduced Deposit Requirement: The government equity loan significantly reduces the initial deposit required, making homeownership more attainable for those with limited savings.

- Access to New Build Homes: The scheme focuses on newly built homes, offering buyers access to modern and energy-efficient properties.

- Greater Choice of Locations: The scheme’s availability across London opens up a wider range of locations and neighborhoods for potential buyers.

- Potential for Long-Term Investment: Owning a property in London can offer potential for capital appreciation, making Help to Buy a strategic investment decision.

Navigating the Help to Buy Process in London:

- Eligibility Criteria: To be eligible for Help to Buy, buyers must meet specific criteria, including being a first-time buyer, having a household income below a certain threshold, and being able to secure a mortgage.

- Finding a Suitable Property: Buyers must choose a property that is eligible for the Help to Buy scheme, which typically includes newly built homes.

- Mortgage Application: Buyers need to secure a mortgage from a participating lender, covering at least 80% of the property value.

- Completing the Purchase: Once the mortgage and loan are in place, the purchase process can be finalized, with the Help to Buy equity loan paid directly to the developer.

Understanding the Implications of Help to Buy:

- Repayment of the Equity Loan: The equity loan is interest-free for the first five years but becomes subject to a fixed interest rate after this period. The loan is repaid when the property is sold.

- Limited Availability: The Help to Buy scheme has a limited budget, and the number of properties available under the scheme is subject to change.

- Potential for Rising Property Prices: While the scheme aims to make homeownership more accessible, it can also contribute to rising property prices in certain areas.

FAQs: Addressing Common Queries

Q: What is the maximum price of a property I can purchase with Help to Buy in London?

A: There is no specific price cap for Help to Buy properties in London. However, the maximum loan available is 40% of the property value, which effectively limits the maximum price you can afford.

Q: How long do I have to live in the property before I can sell it?

A: There is no minimum residency requirement for selling a Help to Buy property. However, the equity loan will need to be repaid when the property is sold.

Q: Can I use Help to Buy to purchase a second home?

A: No, the Help to Buy scheme is only available to first-time buyers or those looking to move up the property ladder.

Q: What are the interest rates on the equity loan after the five-year interest-free period?

A: The interest rates on the equity loan after the five-year period are fixed and determined by the government. The current rates can be found on the Help to Buy website.

Tips for Success: Maximizing Your Chances

- Research Thoroughly: Familiarize yourself with the Help to Buy scheme, eligibility criteria, and the available properties.

- Seek Professional Advice: Consult with a financial advisor and a mortgage broker to understand your affordability and explore mortgage options.

- Be Prepared for Competition: The Help to Buy scheme is popular, and competition for properties can be fierce. Be prepared to act quickly and decisively.

- Consider the Long-Term Implications: Factor in the repayment of the equity loan and the potential for interest rate changes when evaluating your long-term financial obligations.

Conclusion: A Stepping Stone to Homeownership in London

The Help to Buy scheme has undoubtedly played a significant role in enabling individuals and families to realize their dream of owning a home in London. It provides a valuable financial boost, reducing the barriers to entry and opening up opportunities for a wider range of buyers. While the scheme has its limitations and implications, it remains a vital tool for navigating the challenging London property market and achieving the goal of homeownership. By understanding the scheme’s intricacies, eligibility criteria, and potential benefits, aspiring homeowners can make informed decisions and embark on their journey towards securing a piece of the vibrant London landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the London Property Landscape: A Guide to Understanding the Help to Buy Scheme. We appreciate your attention to our article. See you in our next article!